Yesterday, we covered IntentX, and their recent move to Mantle, marking a significant change as the protocol makes the BitDAO-backed L2 its home. Today, we’re briefing you on a few other projects that the Mantle ecosystem has to offer.

From Mantle native projects to established projects that have chosen to build a base on Mantle, there’s a plethora of protocols building, including KTX Finance, INIT Capital, and Merchant Moe.

Background on Mantle

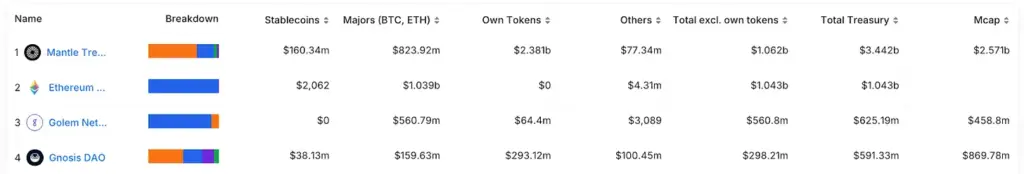

Mantle launched just last year, as the primary product of BitDAO, a DAO backed by bybit among other contributors which boasts the largest treasury in all of DeFi by a longshot.

Mantle is a modular L2 leveraging the OP stack, as well as EigenDA. Beyond just being a chain, the ecosystem as a whole has grown to be quite accommodating on the incentives end.

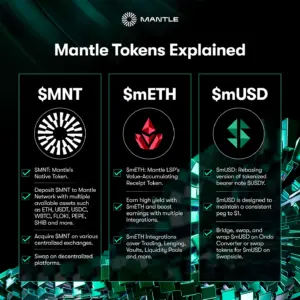

A vibrant community has come to establish itself on the chain, including memecoins like Puff, as well as some interesting projects backed by the Mantle Core team, like MethLab. The chains’ TVL is still relatively low (~$260M) compared to the its treasury size. This means incentives initiatives can have an outsized impact on the growth of the ecosystem.

Background on KTX Finance

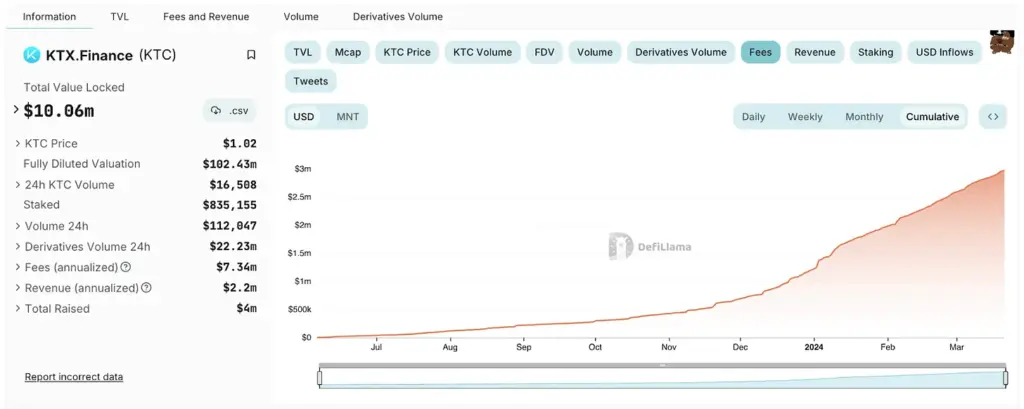

KTX as a decentralized gamified project that addresses common trade-offs in trading, such as custody, speed, and fees. The project functions as a decentralized perps trading platform, derived from GMX’s v1. This includes benefits like 0-price impact trading and a low slippage experience.

On Mantle, users can currently trade $ETH and $BTC, as well as the Mantle-native $MNT. KTX actually launched on Mantle first before expanding to other chains (BNB Chain and Arbitrum currently). The reason for this is that KTX had confidence in Mantle’s team and their execution abilities from early interactions, highlighting Mantle’s developer support, smooth deployment process, and initiatives to promote projects.

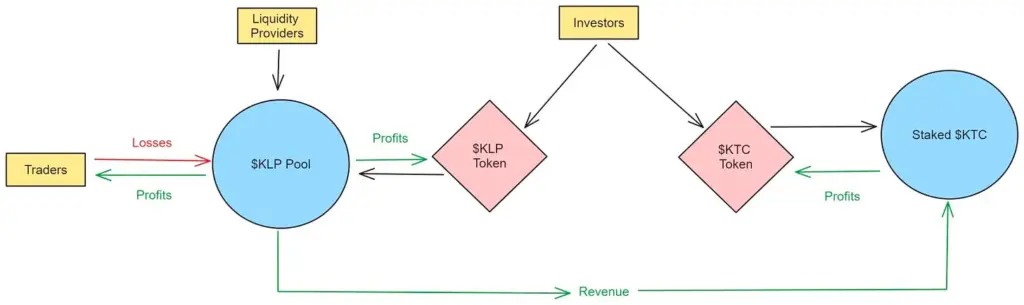

When it comes to providing liquidity into the KLP, users can inject $BTC, $ETH, or $USDT as they please to mint the token. KLP serves as the house, as opposed to traders which can be thought of as players at the casino in the context of GMX v1 and protocols which follow this design. Traders effectively rent liquidity from the KLP and pay a fee for doing so, as this is what enables them to leverage trade. In return, LPs receive 70% of protocol revenue as well as esKTX rewards, a vested version of the native KTC governance token.

KTX has a small KLP allocation to $ETH within their KLP pool, utilizing $ETH in two ways: for liquidity providers, its part of the asset composition earning yield on yield, including $ETH yields and KLP yields from trading fees; and for traders, considering offering perp trading as a $mETH pair once liquidity improves.

In addition to the natively provided opportunities on Mantle, KTX provides numerous opportunities for traders and LPs alike to earn some extra rewards. Minigames and quest esque programs incentivize users to complete certain activities like staking, trading, maintaining open interest, etc. Users can also take advantage of KTX’s ETH Dencun Surge trading competition with $100k+ in rewards up for grabs as the month ends. KTX is pioneering a unique gamified approach to perpetual trading and prediction markets, aiming to become the ‘Robinhood of on-chain trading’. The protocol’s leveraged KLP vault and delta-neutral KLP vault, made possible via integration with Vaultka and Solv Protocol, respectively, also attest to this.

When it comes to future plans, more minigames and a revamped UI are slated for Q2 2024, emphasizing a fast shipping speed from the team. So far, the project has garnered 28k users, with 500 DAU (daily active users), while also generating nearly $3M in fees.

Background on INIT Capital

INIT Capital is a liquidity hook money market on Mantle; the project’s mission is to democratize access to liquidity for both DeFi users and protocols through a composable version of a money market. Specializing in liquidity hooks, this aspect of the protocol was inspired by the design of Uniswap V4.

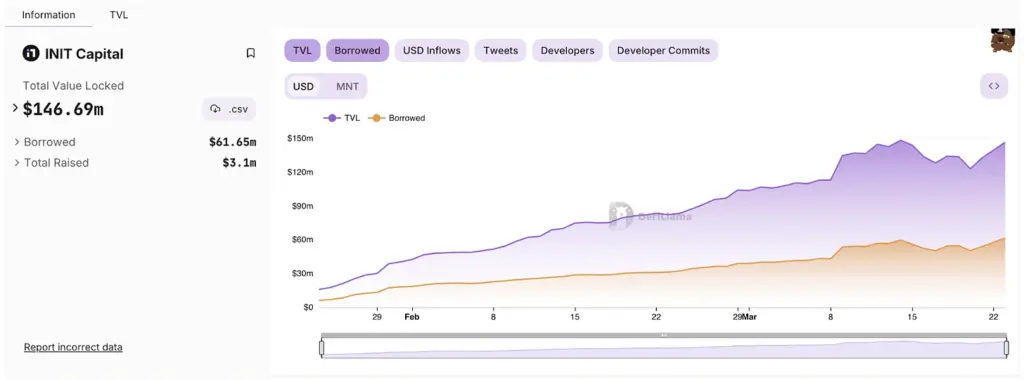

The protocol has some duality in its userbase as individual users can engage in various yield trading strategies and earn incentives, while protocols can integrate with INIT to borrow liquidity directly. INIT has seen immense growth and community support since its launch. This is off the back of a popular points program on the chain, incentivizing users to provide liquidity as collateral and specifically borrow against it, which earns 3x more points.

Notably, a $mETH looping hook strategy is quite popular on the platform, in which $mETH depositors can borrow $ETH at 3x leverage within 1 transaction, eliminating some of the headache of manually looping on lending markets.

Background on Merchant Moe

Merchant Moe describes itself as “a trader’s oasis in the bustling world of DeFi on Mantle Network, offering a comprehensive and user-friendly DEX experience.” The project has ambitions of becoming the central exchange of the Mantle ecosystem through a community-first approach and the power of its core technology, the Liquidity Book. The Liquidity Book is an innovative concentrated liquidity protocol that offers granular control over liquidity, incorporates a volatility oracle to mitigate impermanent loss, enabling dynamic liquidity management, and facilitating composability through ERC-1155 style tokens.

Merchant Moe was introduced by Trader Joe, and leverages its tech on the Mantle network with its own MOE token. The team behind Merchant Moe acknowledges Mantle’s role in supporting a key group of projects that help to foster growth on the chain.

As it pertains to Merchant Moe’s development, ‘Moe Classic’ debuted in January, with plans to deploy more core modules of the DEX and introduce the liquidity book. More partnerships can also be expected as well as veMOE staking to vote on various pools.