Key Points

- A Promising Venture: Mantle is an optimistic Layer 2 network on Ethereum built on the OP stack and backed by BitDAO. BitDAO holds the title of the largest treasury in DeFi, worth:

- ~$300M in stablecoins.

- ~$500M in $BTC and $ETH.

- ~$1.75B in the DAOs native token, $BIT.

- Strong Community & Strategic Partnerships: BitDAO governance and Mantle’s core product will be unified. This combined with accelerated $BIT vesting schedules are catalysts for Mantle. This will spur the growth of the Mantle ecosystem with a $200M development fund.

- Token Migration and Simplified Tokenomics: The $BIT token is planned to be migrated to a new $MNT Mantle token sometime in June. This will create a unified brand and better convey the purpose of the token.

What is BitDAO?

The Mantle blockchain and BitDAO are closely intertwined. To understand the bullish case for Mantle, investors should have a solid understanding of the investor and DAO backing behind it. Mantle is an upcoming optimistic Layer 2 network on Ethereum based on the OP stack. The project is strategically aligned with BitDAO and the $BIT token, which will be migrated to the $MNT token.

BitDAO was originally established in 2021 as an open platform for ideas and experimentation. Because DAOs can sometimes be bureaucratic and slow, BitDAO used a subDAO model to delegate initiatives. The DAO exists with the purpose of tackling issues involving DeFi and building open economic systems. It utilizes its large Treasury to fund things that have goals aligned with the DAO. So far, the DAO has supported a variety of initiatives and pilot programs, including:

- the initial and ongoing Bybit Contribution

- Venture investments

- Broad mandate ecosystem initiatives

- Core product development led by Mantle

- various other ad hoc projects.

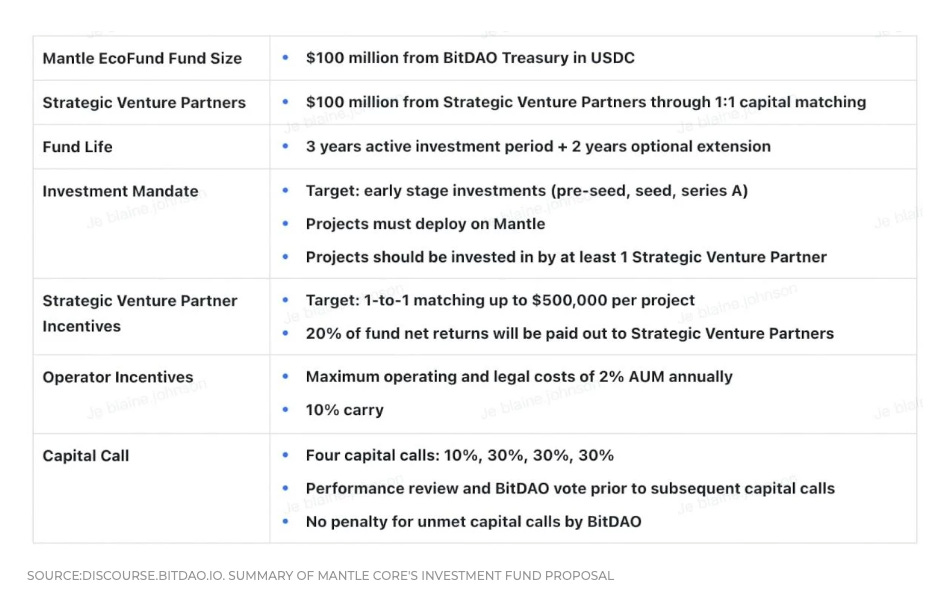

Currently, there is a general agreement among the DAO that building “core products” like Mantle Network should be the primary strategy for user and developer adoption. Right now, Mantle is the primary focus of BitDAO. This is supported by Mantle EcoFund, a proposal put forward by BitDAO. This fund would be a $200m incentive program to boost app development on the Network. This could ultimately accrue value to the $BIT (soon to be $MNT) token.

Mantle Network will be incubated and governed by BitDAO. This comes with the support of prominent BitDAO investors like Peter Thiel, Founders Fund, Pantera Capital, Spartan Capital, QCP Capital, Cadenza Ventures, Folius Ventures, Play Ventures, and Dragonfly Capital. Other institutions including Selini Capital and Lemniscap, have expressed interest in backing the Mantle EcoFund.

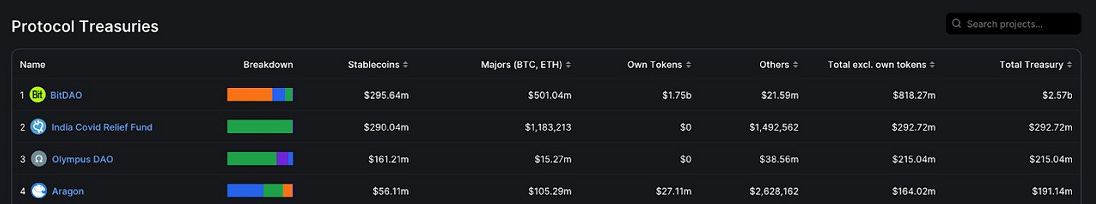

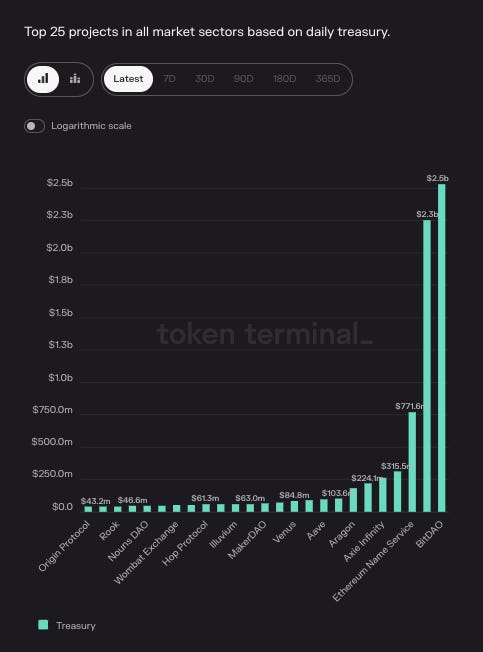

The State of The Treasury

BitDAO currently has the largest treasury in DeFi with almost $300M in stablecoins, ~$500M in $BTC and $ETH, and $1.75B in its own token. As you can see below, this is more than 2x the size of the closest competitor, the India Covid Relief Initiative. For context, the size of BitDAO’s treasury (excluding native tokens) is almost 4x bigger than Olympus DAO. It is more than 11x bigger than Maker DAO and Lido.

Historically, ecosystem funds have served as an important catalyst of growth for new emerging protocols and ecosystems. In particular, developer and dApp adoption of a new chain can experience a lot of growth from ecosystem funds. The Mantle Core team put forward a proposal to establish a $200M fund aimed at promoting ecosystem growth. Half of that amount of capital would come from BitDAO’s treasury with the other half coming from strategic investors. The DAO is basically going to match the 100M the investors put in. The fund proposed to have a 3-year active investment period where all investors would have an equal stake in all the new projects. Up to $500,000 in investment would be made available for each startup.

To this day, Bybit has contributed more than $600M USDC/USDT and 177k ETH to the BitDAO treasury. This is more than enough to support the development of BitDAO’s initiatives. Most notably, this includes the Mantle EcoFund, which entails $100M in funding coming from BitDAO’s treasury. Going forward, Bybit will still remain an important sponsor and partner. Bybit can contribute specifically in the areas of product ideation, bootstrapping product development, user onboarding, and product distribution.

After the completion of the 2.7B BIT (MNT) fixed-schedule contribution, Bybit will likely remain the largest holder of BIT (MNT) and be incentivized in BitDAO’s success (see wallet holdings).

1 $BIT = 1 $MNT

The Mantle token needs to reflect the vision of the protocol itself, being a Layer 2 product ecosystem. This is different compared to an investment ecosystem like BitDAO, which is why the existing $BIT token cannot be used. The tokenomics required for an investment DAO and an L2 are different. $BIT was designed to be a governance token, nothing more. The most important change is that $MNT will be a gas token. The new token will also include Mint and Burn functions and the ability to be upgraded in the future. These are all seen as necessary functions of an L2 token. This justifies the migration from $BIT to $MNT and the accompanying proposals that tweak the token properties.

The migration from the current $BIT token to a new $MNT token via BIP-21 has not been taken lightly. In simple terms, users can more easily grasp the value and purpose of the token when it is named after the chain. Mantle = $MNT. Simple, right? The main goals behind the migration are to:

- ensure the prosperity of long-term holders.

- preserve their current economic and governance rights.

- help to increase the chances of success of BitDAO’s core product, the Mantle Network.

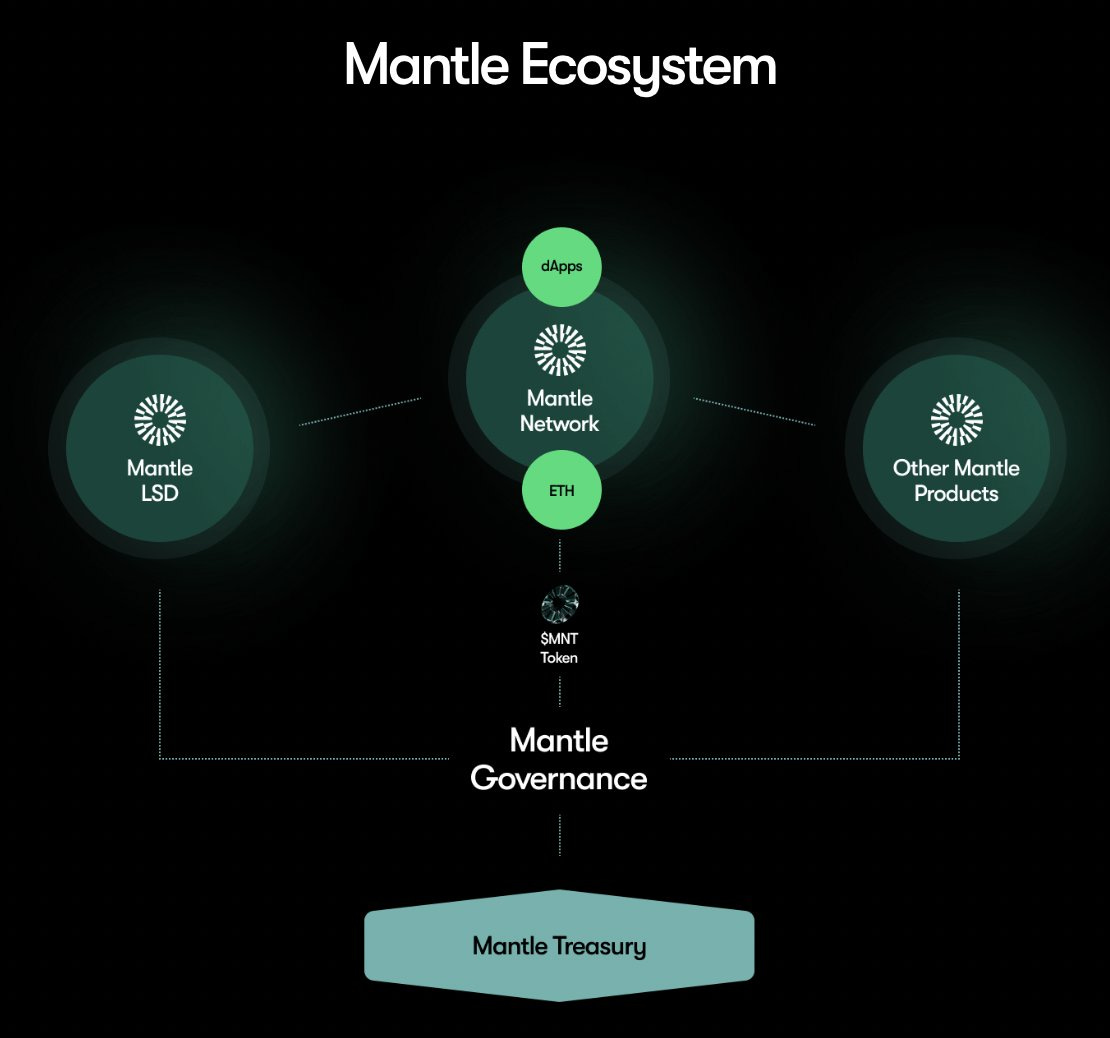

Merging the brands before the Mantle mainnet release is a strategic move. The goal here is to help create a unified identity for the ecosystem. The existing BitDAO Treasury holdings and exposure will remain under the governance of token holders. The only difference is that moving forward, the BitDAO treasury will be referred to as the Mantle Treasury. Token holders will retain the same rights, they will just be holding $MNT instead of $BIT.

The migration to $MNT also introduces some simplified tokenomics. Simplified tokenomics will help the Mantle Network mainnet to start out under a unified ecosystem. This will solve problems such as the unpredictable nature of the $BIT circulating supply (more on this later), and the concentration of $BIT holdings.

Upon launch, Mantle will be able to bootstrap the BitDAO brand with a product focus. In fact, the proposed change to BitDAO is a cosmetic rebrand only and will not result in material changes to primary DAO functions. These include core governance, resource management, treasury management, and existing initiatives. This becomes increasingly important considering the competitive landscape of L2s. Despite bearish market conditions, there are ever-growing ecosystems being developed on zksync, Starknet, Synapse chain, Polygon zkEVM, Metis…

To make the transition to $MNT as easy as possible, the migration will include:

- Multiple official token conversion channels.

- The token migration will follow a fixed conversion rate for all holders to maintain all current shares of governance power. This rate was recently changed to 1:1. So 1 $BIT = 1 $MNT

- Because the conversion will take place on Ethereum mainnet, the team will try to be considerate of gas fees and bridging fees to the Mantle L2. Bybit will be offering gasless transactions for small balances of $BIT.

- The current $BIT/$ETH Uniswap pool will be deprecated. The liquidity will be transferred to a new $MNT/$ETH pool.

One of the biggest supporters of BitDAO is Bybit, one of the most popular CEXs in crypto. As a company, Bybit shares many of the same goals of decentralization and crypto adoption as BitDAO. Over the years, Bybit has contributed some ~$600m in stablecoins and 177k $ETH to the BitDAO treasury. The current dynamic behind Bybit’s contributions depends on the trading volume of the exchange. Specifically, the CEX pledged to give 2.5bps of their futures trading volume to the treasury.

All contributions due from the BIP-20 proposal and remaining vesting schedules from launch have been accelerated to simplify the token circulating supply and make it more predictable. This includes 2.58b $BIT originally scheduled across 48 months and 2.8125b $BIT that was originally vested from launch. This way, there will be no outstanding vesting schedules from the original BitDAO launch. This brings the following benefits:

- The BitDAO team can focus on the tokenomics behind their initiatives and the success of the Mantle Network. Currently, the team is incentivized based on Bybit’s performance.

- Decouple the economic and legal exposures of BitDAO and Bybit. This reduces the likelihood of $BIT (soon to be $MNT) being viewed as a “Centralized Exchange Token”. This in turn reduces risk from future regulation while also paving the way for $MNT to be listed on other CEXs. These CEXs might currently see Bybit as a competitor, and wouldn’t want to list a token directly affiliated with them. It is expected that the CEXs currently listing $BIT will opt to also list $MNT.

- Focus on user growth, instead of treasury growth. It is true that treasury resources are critical for development and longevity. But ultimately, the prosperity of BitDAO is mostly accelerated through product and user adoption. This also helps the ecosystem be more sustainable.

- More predictable token circulating supply, which will make it easier to compare the token’s performance relative to other tokens and benchmarks.

While it might seem that inflationary pressure would hit the market and negatively impact price action, this is not the case. The contributed tokens have already been moved to the treasury. These tokens are typically on a one-way trip and are not moved without a governance proposal and vote. As a result, this acceleration does not generate additional circulating supply. Instead, it may help to convey a more compelling message regarding future incentive programs to build a new ecosystem of applications.

What’s more, BIP-20 has a significant impact on the token’s supply. The circulating supply of $BIT (defined as the supply outside of the BitDAO Treasury and Burn address) will be reduced from approximately 6.0B (3.3B treasury, 0.7B burned) to 3.3B (6.0B treasury, 0.7B burned). This represents a 1.8x boost of BitDAO economics and governance voting power for all existing $BIT ($MNT) holders.

It is worth noting that the circulating supply of $BIT or $MNT can be increased from any distributions and issuance from the BitDAO Treasury (approved by future BIP proposals). The circulating supply can also be decreased via any approved burn. The $MNT supply and tokenomics can be dynamic, and controlled by the DAO community via vote.

$MNT - One Brand, One Token

$MNT will play a central role in the Mantle ecosystem. It will be used as the gas and staking token for the Mantle Network. The token will implement a tokenized governance system to support builders and leverage the BitDAO treasury through contributions, and partnerships. Currently, the BitDAO treasury and governance live on the Ethereum mainnet. Because of this, the conversion to $MNT will also happen on Ethereum L1. Bridges will be used to get tokens over to the Mantle network. The team plans to implement a lock and mint model for those bridging to L2. This ensures that $MNT balances on both L1 and L2 match.

Mantle Network: What You Need to Know

The main goal of building Mantle is to develop a competitive and improved Layer 2 ecosystem. One of the implications of this is that a new token is needed. A new smart contract and more functionality enable use cases that would not be possible with $BIT.

The upcoming Mantle mainnet launch is planned to take place in Q2 or Q3 2023. Ecosystem protocols include Sphere Finance (launchpad), Mantleswap (DEX), Fusion X (DEX), while other prominent players like Multichain, Synapse, Ankr, or Pyth have also expressed their intent to deploy on Mantle. Nonetheless, speculation suggests a potential focus on gaming. The team has inked a partnership with Game7 and received investment from Mirana Ventures.

Modular Design

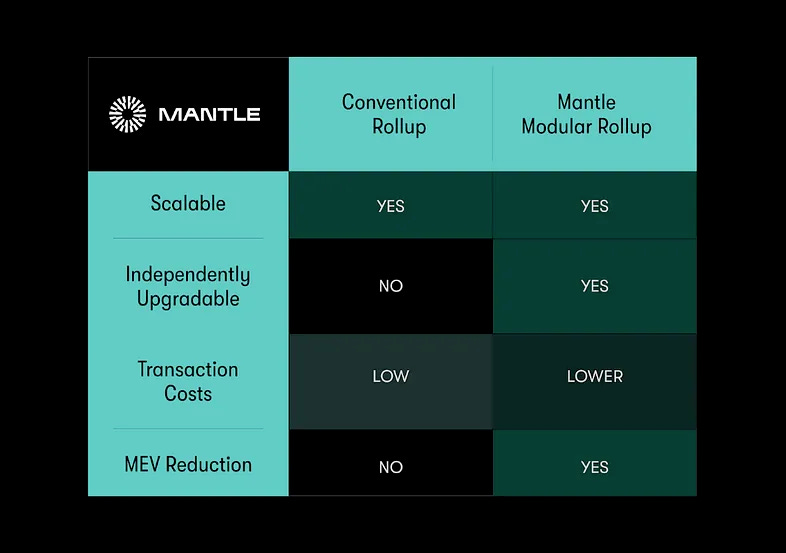

The most notable feature is the modular architecture and the integration of Eigenlayer’s EigenDA for data availability. Cutting data storage costs is key to advancing scalability, since posting transaction data to the L1 is one of the most cost-intensive operations in the rollup transaction cycle. Using EigenDA for data availability allows staked $ETH to be used for securing both Ethereum and applications built on top of Mantle. This integration is also what makes it possible to use $MNT as the gas token.

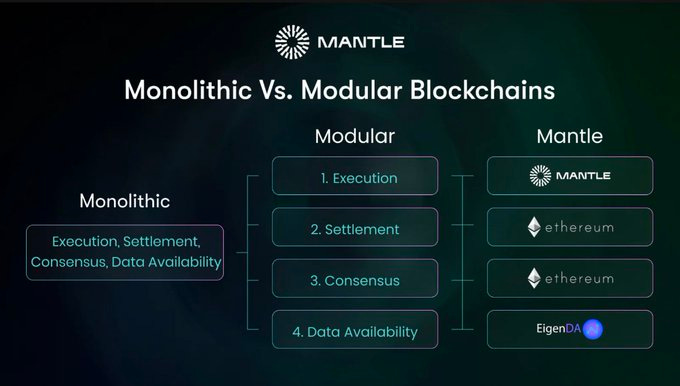

The modular design is a significant shift from the monolithic designs commonly seen in blockchains like Ethereum, Binance Smart Chain, and Solana. In the monolithic model, all the primary blockchain functions like execution, consensus, settlement, and data availability are conducted at the node/network level. This concentration of functions can cause high gas fees, constraints in throughput, and other performance bottlenecks. Basically, blockchains that perform all their functions on one layer can have problems scaling. Mantle Network takes a different approach. It delegates each function to a separate layer in the blockchain, run by different network actors. This separation allows each layer to specialize, delivering improved performance, lower gas costs, and enhanced scalability.

Decentralized Sequencer

Progressing Ethereum through conventional rollups creates a point of centralization with the sequencer, which is a node responsible for including and ordering transactions within a batch. Most optimistic rollups today, like Arbitrum and Optimism operate with a single centralized sequencer. This is detrimental to censorship resistance and opens up opportunities for MEV capture by reordering or omitting transactions from a batch.

- Security risk: Sequencers that have priority write access to the L2 chain are the only entity that can submit transaction bundles to the L1 contract. This poses a potential security risk, as malicious actors could exploit this privileged position.

- Operational risk: The reliance on the core team to operate the Sequencer is a single point of failure in the system. If the core team’s operations are disrupted, the entire system could stop operating.

Clearly, there are some risks in implementing centralized sequencers. A decentralized sequencer, on the other hand, is a network component that is made up of multiple nodes. This enhances the overall security and robustness of the system. It does this by eliminating the single point of failure present in centralized sequencer systems.

Mantle implements a decentralized sequencer selection process to mitigate censorship resistance and MEV. Even though this scheduler is centralized, it takes on the responsibility to elect a new sequencer node that will produce the block for each batch, adding a level of decentralization to the block production process. Furthermore, nodes acting as sequencers will receive rewards in $MNT, the native token of Mantle. They can also benefit from any Miner Extractable Value (MEV) available through block production.

EVM-Native Fraud Proofs

In blockchains, fraud proofs play an important role. As the name suggests, these fraud proofs serve the primary purpose of verifying that all on-chain data is indeed correct. In addition to preventing fraud, fraud proofs also help scale blockchains by lowering costs and maintaining low latency levels.

Traditional Optimistic rollups include the on-chain verifier, which is the contract that settles disputes. The on-chain verifier can only execute its instructions in a lower-level virtual machine such as MIPS or WASM. For the on-chain verifier to understand the fraud-proof, an EVM client needs to recompile their fraud-proof into a lower-level language so that it can be understood. This compilation occurs outside the scope of the EVM.

Because this process occurs outside of the EVM, there is an inability to verify that a fraud proof’s contents derive directly from a compliant EVM client. This then creates a significant blind spot. Basically, the on-chain verifier is unaware of the fraud-proof producer. This interferes with the trust minimization that is present in the Ethereum blockchain client.

Instead, Mantle will implement an EVM-native fraud-proof system. By using EVM-level instructions, all Ethereum clients can interact with a common proof system in a permissionless way. This also reduces the number of trust assumptions that are made across all of the verifiers, clients, and compilers.

Conclusion

Mantle is a promising up-and-coming blockchain with an interesting approach to scaling on top of Ethereum. Being a core product of BitDAO comes with some significant perks. For one, Mantle will have access to a piece of the largest treasury in DeFi. The blockchain will also have a lot of strong investor backing and guidance from Day 1, giving it a unique advantage compared to other chains. A large treasury of BitDAO combined with the $200m Mantle EcoFund will help to bolster developer and user activity. Tokenomics have been simplified via the new $MNT ticker and the looming vesting schedule has already been transferred over to the BitDAO treasury. With all this in mind, $MNT is certainly something to keep an eye on as Mantle grows into its launch.