In today’s edition, we’re briefing you on the latest with Mantle, with some insights from Jordi Alexander, CIO of Selini Capital and also Alchemist at Mantle.

$MNT has seen a bit of action lately, and with EIP-4844 coming up, it may be more rewarding to research the nuances between top competing L2s. Mantle’s user-oriented approach is playing out, with its double yield $mETH LSP gaining traction and a growing ecosystem of interesting dApps.

Origins of Mantle

- Initially known as BitDAO, it operated as a semi-independent entity attached to Bybit with a focus on investments.

- BitDAO currently has the largest treasury in DeFi, sitting at over $2.75B. Notably, $MNT comprises almost 80% of this figure.

- To this day, Bybit has contributed more than $600M USDC/USDT and 177k ETH to the BitDAO treasury.

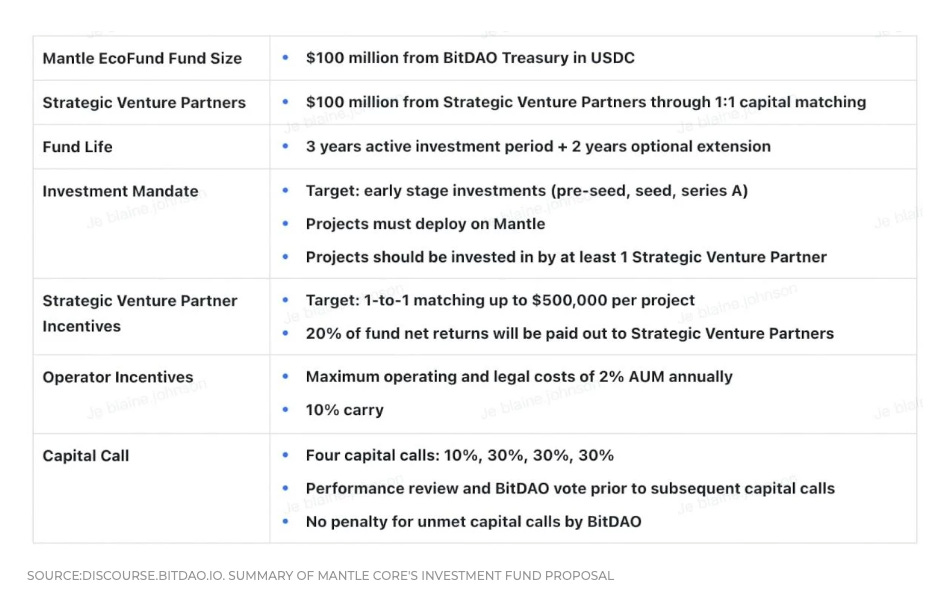

- This is more than enough to support the development of BitDAO’s initiatives. Most notably, this includes the Mantle EcoFund, which entails $100M in funding coming from BitDAO’s treasury ($200M in total with funds from investors).

Mantle EcoFund Breakdown

- Going forward, Bybit will still remain an important sponsor and partner.

- Bybit can contribute specifically in the areas of product ideation, bootstrapping product development, user onboarding, and product distribution.

- However, after observing issues with investment-focused approaches (e.g., 3AC), they decided to pivot towards being more product-focused.

- The rebranding from BitDAO to Mantle represented this shift, with Mantle being a layer-2 of Ethereum.

- The token was converted from the old $BIT to the new $MNT to align with the fresh start and product-focused direction.

- The decision to convert tokens from BitDAO to Mantle was driven by the desire for a fresh start and emphasis on product development.

- Although many people were attached to the name “Bit,” they recognized the importance of rebranding for clarity and focus.

- The token conversion involved migrating from the old $BIT to align with Mantle’s vision.

- This transition allowed them to upgrade their approach and fully embrace a product-focused strategy.

Why Was Mantle Created?

- Jordi Alexander, Alchemist at Mantle, says that as most liquidity and activity are happening on Ethereum, it makes sense for a layer-2 solution to be part of that ecosystem.

- Building on Ethereum provides security and allows for easy bridging to the main Ethereum network.

- Mantle’s decision to build its own chain is driven by the goal of being a product-focused DAO.

- By building on Ethereum, Mantle can leverage its existing mindshare and security.

- Many other major layer-2 solutions are primarily focused on technology development.

- Mantle takes a different approach by prioritizing end-user experience and focusing on building a safe app environment with ample liquidity and support.

- While partnering with other layer-2 technologies for their technical expertise, Mantle aims to provide the best user experience rather than solely competing on technology advancements.

- Jordi says that many apps deploying on other layer-2 solutions lack strong partnership networks and business development focus.

- By prioritizing these aspects, Mantle gains an advantage in attracting apps and users who value a strong ecosystem with robust support.

- While technology-focused layer-2 solutions have their merits, Mantle’s focus on user experience sets it apart as a unique player in the market.

- Mantle has adopted a modular approach; the early adoption of technologies like the Eigenlayer contributes to Mantle’s focus on making transactions cheaper and improving user experience.

- Jordi also emphasizes the importance of affordable transaction fees for users.

Mantle Ecosystem

- Init Capital is an intent-based borrowing and lending, taking inspiration from Uniswap’s hooks feature.

- The team behind Init Capital is described as highly skilled, and more details will be announced soon.

- Butter is a decentralized exchange built on Mantle with a gamified approach.

- It offers unique features and has a strong development team.

- Merchant Moe aims to be an equivalent version of Trader Joe but with its own separate token ($MOE, airdropped to JOE stakers ).

- It provides trading opportunities with a focus on blue-chip assets.

- 10% of the tokens will be distributed to Trader Joe users as an extra airdrop.

- He adds that Merchant Moe is not just a rebranding of Trader Joe; it is built on Mantle and has its own separate team.

- The decision to create Merchant Moe was influenced by the Mantle platform, not any legal issues related to Trader Joe.

The mETH Lab for yields

- One key project on Mantle is MethLab.

- MethLab describes itself as an intent-based protocol, offering next-gen forms of non-liquidation borrowing.

- Notably, MethLab is drawing attention for its UI where users, (or perhaps ‘players’) walk around a virtual MethLab instead of simply navigating a webpage.

- the v1 is in testnet, designed by Jordi Alexander.

- The project has plans for leverage in the future.

Metlab’s gamified UI

- Jordi explains that mETH Lab is an upcoming lending and borrowing feature on Mantle.

- It offers a unique approach where users can specify the desired yield they want to achieve.

- Instead of starting with collateral, the focus is on determining the desired yield and then adjusting the requirements accordingly.

- He adds that this approach allows for more flexibility in borrowing against tokens like $mETH.

- There is no liquidation mechanism, making it safer option without the need for oracles.

- Jordi says that non-liquidation mechanics, similar to those used by Timeswap, offer exciting possibilities.

- Shared lending protocols have not fully explored this use case yet.

- As markets become more volatile during bull runs, there is significant potential for innovative lending solutions.

- He adds that the Meth Lab product is being built by the Core Mantle team, and is one of the Showcase apps.

- The team has extensive experience and expertise in building innovative solutions.

$mETH and 2x average staking yield

- mETH is similar to other liquid staking protocols like Lido.

- It allows users to stake their $ETH and receive receipt tokens that can be used in DeFi applications.

- The development team behind $mETH has significant experience and has conducted thorough audits for security.

- Similar to Lido, mETH offers a liquid staking protocol where users can stake their ETH and receive receipt tokens for use in DeFi.

- The team aims to become a strong competitor in this space by targeting the number three spot among liquid staking providers.

- They want to offer users more options, encouraging them to switch from existing solutions or start staking their ETH for the first time.

- The team aims to provide the highest yield compared to other competitors.

- They announced a double dose yield drive for the first 250,000 ETH staked in $mETH, effectively doubling the yield from 3.6% to 7.2%.

- The double yield will be paid natively in $ETH, not in another token.

- The treasury’s yield funds this initiative, and they are confident in its sustainability.

Partnership with Ondo Finance (mUSD)

- A partnership exists between Mantle and Ondo Finance regarding the $USDY product.

- Native yield can be generated within DeFi applications using $USDY without needing KYC verification.

- Previously, accessing similar products required KYC verification, but now it can be done permissionlessly.

- An ideal layer-2 environment should include native building blocks that generate yield.

- Mantle has partnered with Ondo to mint $USDY, a stablecoin that provides treasury yield.

- The Mantle team appreciates Ondo’s approach, as they are regulated and have extensive experience in the space.

- Users can access $USDY on Mantle without needing to go through KYC verification.

- Users can access $USDY on Mantle without having to go through the complex process of minting it themselves.

- A large portion of the treasury funds has been allocated to mint $USDY, making it more accessible.

- $mUSD is a one-to-one pegged dollar coin exclusively managed by Ondo for Mantle.

- Some apps may prefer using $USDT due to its non-rebasing nature, while others may opt for rebasing tokens like $mUSD.

Partnership with Ethena Labs

- Ethena Labs is a stablecoin project that utilizes liquidity for perpetuals.

- It offers two sources of yield – $stETH and funding rates from shorting.

- Despite being controversial due to its use of centralized exchanges, it remains crypto-native.

- It’s collaboration with Bybit was driven by their large open interest and integration with $mETH as collateral.

- Users can buy $mETH for yield or create a neutral position by shorting ETH Perpetual.

- Perpetual exchanges have funding rates where longs pay fees to shorts.

- Positive funding rates are common during bull markets, resulting in significant fees paid by long positions.

- Once Ethena goes live, higher yields are expected due to positive funding rates.

- On-chain perpetual mechanisms are limited currently, but there is potential for growth in the future.

Utility of MNT token and why to stake MNT

- MNT serves as the gas token for using the Mantle Network.

- Gas fees are paid in $MNT, although efforts have been made to optimize gas usage.

- Future plans include staking $MNT to receive airdrops from Ecosystem Fund tokens associated with Showcase apps.

- Being a Showcase app means that Ecosystem Fund has invested in them as a normal VC investment.

- He adds that similar strategies have been successful with other projects like ATOM holders receiving airdrops from Cosmos chains aligned with their ecosystem.

- Injective and Celestia are examples of tokens that have seen price increases due to people playing this game.

- Mantle acknowledges the speculative nature of the cryptocurrency market and the advantages that projects without live tokens may have.

- Some layer-2 solutions could potentially be valued similarly to Mantle, resulting in significant market capitalization.

- To address this, Mantle aims to reward long-term stakers with future airdrops from protocols built on their platform.

- Unlike other projects with unlock periods for token holders, Mantle made the decision to fully vest all tokens immediately from day one.

- This eliminates concerns about large token holders waiting for unlock dates to sell their holdings.

- The absence of unlock periods is seen as an advantage rather than a disadvantage.